Yhdysvallat matkalla vararikkoon

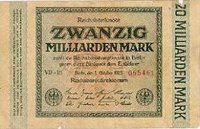

Elämme mielenkiintoisia aikoja.. Jenkkien talouden mittarit näyttävät punaista. Vastuita on enemmän kuin tulevilla ikäluokilla maksukykyä. FED on lakannut ilmoittamasta liikkeelle laskemansa rahan määrää. Puhutaan "korttitalosta", "hyperinflaatiosta", "aikapommista".

Elämme mielenkiintoisia aikoja.. Jenkkien talouden mittarit näyttävät punaista. Vastuita on enemmän kuin tulevilla ikäluokilla maksukykyä. FED on lakannut ilmoittamasta liikkeelle laskemansa rahan määrää. Puhutaan "korttitalosta", "hyperinflaatiosta", "aikapommista".

Telegraph.co.uk kirjoittaa seuraavasti:

The United States is heading for bankruptcy, according to an extraordinary paper published by one of the key members of the country's central bank.

A ballooning budget deficit and a pensions and welfare timebomb could send the economic superpower into insolvency, according to research by Professor Laurence Kotlikoff for the Federal Reserve Bank of St Louis, a leading constituent of the US Federal Reserve.

Prof Kotlikoff said that, by some measures, the US is already bankrupt. "To paraphrase the Oxford English Dictionary, is the United States at the end of its resources, exhausted, stripped bare, destitute, bereft, wanting in property, or wrecked in consequence of failure to pay its creditors," he asked.

According to his central analysis, "the US government is, indeed, bankrupt, insofar as it will be unable to pay its creditors, who, in this context, are current and future generations to whom it has explicitly or implicitly promised future net payments of various kinds.

Prof Kotlikoff, who teaches at Boston University, says: "The proper way to consider a country's solvency is to examine the lifetime fiscal burdens facing current and future generations. If these burdens exceed the resources of those generations, get close to doing so, or simply get so high as to preclude their full collection, the country's policy will be unsustainable and can constitute or lead to national bankruptcy.

Does the United States fit this bill? No one knows for sure, but there are strong reasons to believe the United States may be going broke."

Lisää luettavaa:

USA:n korttitalo osa XIX, XVIII, XVII, XVI, XV, XIV, XIII, ...

What is money?

Wiki: Money Supply

U.S. National Debt Clock

The End of Dollar Hegemony

Some texts in English also - please click

Some texts in English also - please click

Ei kommentteja:

Lähetä kommentti